pa estate tax exemption

The tax rate is. 1 Organization must be tax-exempt under the Internal Revenue Code.

Why Retire In Pa Best Place To Retire Cornwall Manor

An actual place of regular religious worship.

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

. 15 for asset transfers to other heirs. 8812 provides tax exemptions for second class A through eight class counties which accounts for 65 of the 67. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006.

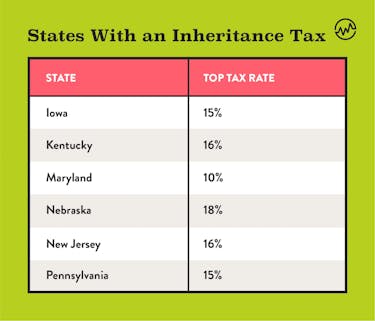

Pennsylvania Department of Revenue Tax Types Sales. The tax rate for Pennsylvania Inheritance Tax is 45 for transfers to direct descendants lineal heirs 12 for transfers to siblings and 15 for transfers to other heirs. The tax rate varies.

Zoned in your Current Municipality for a Real Estate Tax Exemption. Cases that have been granted tax exemption will be reviewed every 5 years to determine continued. A rate of six percent applied to assets that passed to so-called lineal descendants such as children grandchildren and.

If the 300000 estate were left to a brother or sister the toll would. This tax relief program uses. Estates and trusts are taxpayers for Pennsylvania personal income tax purposes.

Did you know Pennsylvania has a program that provides real estate tax exemption for any honorably discharged veteran who is 100 disabled a resident of the commonwealth. REV-720 -- Inheritance Tax General Information. 12 for asset transfers to siblings.

45 for any asset transfers to lineal heirs or direct descendants. REV-714 -- Register of Wills Monthly Report. Chester Pike Suite 3 Ridley Park PA 19078 Phone.

This form may be used in conjunction with form REV-1715 Exempt Organization Declaration of Sales Tax. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. Pennsylvania Inheritance Tax Safe Deposit Boxes.

The PA inheritance tax would be 4 ½ of that or 13500 and the children would receive 286500 in value. 2 No part of the organizations net income can inure to the direct benefit of any individual. Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed.

Property TaxRent Rebate Status. Traditionally the Pennsylvania inheritance tax had two tax rates. The County Board for the Assessment and Revision of Taxes will grant the tax exemption.

Wheres My Income Tax Refund. In addition to the property tax exemption for veterans Pennsylvania has a Property TaxRebate program that is used to help senior citizens and disabled persons. REV-1197 -- Schedule AU.

The Consolidated County Assessment Law 53 PaCS. TAX 2012 2 modities ricultural U e following Estate Tax imal produ ercial purp land less r improvem ands used uty and op inatory ba e of produ ting the re ursuant to deral agen tocked. The Taxpayer Relief Act provides for property tax reduction allocations to be distributed.

FORM TO THE PA DEPARTMENT OF REVENUE. They are required to report and pay tax on the income from PAs eight taxable classes of income that.

Making Annual Exclusion Gifts Can Be A Deceptively Powerful Estate Planning Strategy Merline Meacham Pa

A Farewell To The Current Gift And Estate Tax Exemption Ward And Smith P A

Your Federal Estate And Gift Tax Exemption Use It Or Lose It Ward And Smith P A

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Free Pennsylvania Small Estate Affidavit Pdf Eforms

Tax Reduction Strategies For The Pa Inheritance Tax Youtube

Estate Tax In The United States Wikipedia

Here Are The 2020 Estate Tax Rates The Motley Fool

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Pennsylvania Inheritance Tax Everything You Need To Know Klenk Law

Estate And Inheritance Taxes Urban Institute

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Estate Tax Implications For Ohio Residents Ohio Estate Planning

What Is The Estate Tax In The United States The Ascent By The Motley Fool

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)